June 26, 2020

Cryptocurrencies and Blockchain Technologies in Design

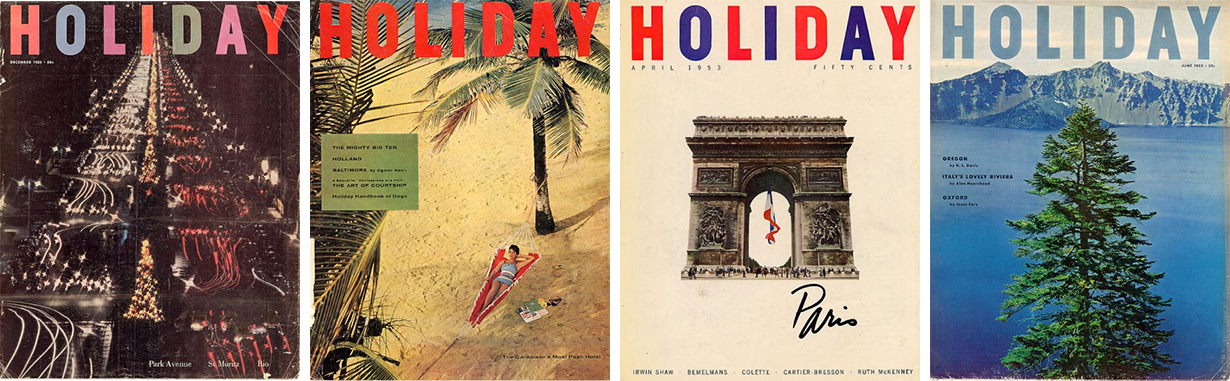

Courtesy of Robert L. Norton, Verisart. Shepard Fairey, Certificate of Authenticity.

From Nakamoto to Facebook’s Libra, DApps, the art market, and COVID-19

Over a decade has passed since the paper Bitcoin: A Peer-to-Peer Electronic Cash System was published to a cryptography mailing list by the pseudonymous Satoshi Nakamoto. In the 8-page white paper Nakamoto proposed a decentralized currency, Bitcoin, built on “a peer-to-peer network using proof-of-work to record a public history of transactions.” Each transaction would originate with a time stamp server, next hashing these transactions “into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed.” In theory this democratized system would lower double-spending and foster greater trust among users through disintermediation — eliminating corporate oversight, gatekeepers, or a central authority. In practice, Bitcoin and the blockchain technology it is built on (the framework which verifies transactions in a peer-to-peer hashed network) has been exciting, controversial, and at times puzzling in its capabilities, for users and non-users alike.

Looking back at the history of the design of cryptocurrencies and the blockchain, some of Bitcoin’s earliest supporters came from computer science, design, and web development backgrounds. Bitcoin’s very first transaction recipient was Hal Finney, a computer scientist, developer, and cryptographer, who was a “well-known figure within the cypherpunks, another early ’90s, mailing-list-centered group focused on empowering individuals with encryption, preserving privacy, and foiling surveillance.” Computer engineer Wen Dai also played a prominent role, developing b-money and the open-source cryptographic algorithms in the Crypto++ library, and was one of the few people that the pseudonymous Nakamoto cited in their white paper.

What began as a fairly cryptic system utilized by fringe groups has expanded into a plethora of designed products and services, revered, scorned, and debated widely. This has included Facebook’s proposed global currency, the heavily-scrutinized Libra — which is now undergoing a system redesign after a series of setbacks, and was criticized as posing a risk to the global financial system. In theory, the initial proposal was fairly clear. This new currency would provide inexpensive and instantaneous global money transfers and basic banking services, which could be beneficial to low-income individuals in developing countries. For example, sending $1000 from the U.S. to Ethiopia through a Western Union transfer incurs at least $7.00 to as much as a $108.00 fee for instant transfer. In comparison, this same transaction through a low-cost option like Libra, secured by cryptography, would in principle have a close to zero transaction fee.

Today, the applications are potentially vast. There is an exhaustive array of crypto hardware wallets like Dropbit and Electrum; to open-source blockchain-based distributed computing platforms like Ethereum through which other programs can be developed. In his article “The Year in Ethereum” L4 cofounder Josh Stark cited a variety of Ethereum-based applications, including the currency Maker Dao. This global movement has also sparked the creation of conferences, podcasts such as Laura Shin’s Unchained, an MIT online short course, an inaugural master’s degree from Cyprus’ largest university, and over 4,400 meetup.com groups.

In light of COVID-19, a number of blockchain-powered applications have also arisen in response to this unprecedented pandemic. Hasshi Sudler, CEO of Internet Think Tank, is in the midst of developing a “permissioned blockchain” to track “COVID-19 cases, possibly getting ahead of future outbreaks.” The World Health Organization, in partnership with Hacera and companies like IBM, Oracle, and Microsoft are working to design the MiPasa platform, an early detection platform that can detect “COVID-19 carriers and infection hotspots.” While this only depicts a sample of the available products and services, blockchain technologies and cryptocurrencies continue to demonstrate innovative capabilities, while simultaneously suffering from lingering problems with public perception.

In design and the visual arts, there have been a number of notable blockchain-powered applications designed and developed by companies like Chromia, Verisart, Monegraph, Artomatix, and Maecenas. Stockholm-based Chromia has designed and developed a “relational blockchain application” which can build more direct relationships between creators and consumers. In an interview with Chromia’s technical director, August Botsford, he described how Chromia can “benefit creative professionals by providing access to digital services (social networks, file storage, advertising, content hosting, creative tools) which are operated in a democratic way. In theory, these DApps remove the profit incentive of centralized operators, and can be expected to more directly serve the needs of their users.” DApp stands for a decentralized application running on a distributed computing system. As observed by Botford, “big tech wields increasing amounts of power with very little accountability”, but a DApp can “democratize digital services, giving individuals true ownership of their online lives.”

Consider also the California-based company Verisart, whose mission is to “create secure digital certificates for art and collectibles.” Verisart provides blockchain certification to the arts and collectibles market, helping artists, merchants, online auction houses and galleria move to a more secure and useful digital certification standard replacing paper with digital identities for objects of value. Verisart is led by founder & CEO Robert Norton, who launched AOL UK’s first shopping channel, launched the natural health website clickmango.com, and restructured and relaunched Saatchi Online before co-founding Verisart. In my interview with Norton, he expressed that the “benefit of decentralization is that all parties are now working according to the same set of cryptographic standards and this means there is indisputable consensus over when something was recorded or transacted.” Pointing to a specific use case, Norton recounted his work with a number of leading artists who use the Verisart platform to create certificates of authenticity for their creative output– “for example, the artist Shepard Fairey decided to use Verisart to certify his fine artworks and now when you buy one of his works you get a digital certificate of authenticity which connects you to the artist and which can be freely transferred at the time of sale.” Fairey has himself been sued for copyright infringement in a case around his HOPE poster by the Associated Press, in a case that was settled in 2011.

Singapore-based company Maecenas “is a marketplace that allows anyone to purchase fractional interests in great works of art, using the ease and efficiency of blockchain technology.” Founder and CEO Marcelo García Casil, explains that the “platform makes it easy to buy asset tokens, which represent a share of a masterpiece, giving everyone access to invest in the greatest artists of all time, such as Picasso, Monet, and Warhol. The artworks on the platform are carefully curated by experts for their cultural significance, quality, and hold of value.” Through the decentralized nature of the platform, Casil notes that “the blockchain means that there isn’t a single source that maintains all the data and records”, it’s more difficult to hack, and less vulnerable to fraud. Casil further stated in our interview: “In the art world, the private nature of transactions makes the market very opaque and difficult for non-art experts to determine what a fair value is to pay. A blockchain art market and online platform creates a clear price discovery mechanism … The use of smart contracts also ensures fair pricing and leverages the efficiencies of using modern technology to minimize fees at scale.” In an asset class typically only available to wealthy patrons, Casil also seeks to “democratize access to fine art ownership.”

A decade in the making, cryptocurrencies and blockchain technologies have moved beyond prototypes into well developed, highly designed applications. In the midst of a global economic fallout, this may be the time for the accelerated use of these new technologies, where feeling of trust, democratization, and accessibility, and the role of design and art become even more of an imperative. Reflecting on this notion, Norton suggested, “Together these technologies may mark the start of a new digital renaissance for creators.”

Observed

View all

Observed

By Laura Scherling

Recent Posts

A quieter place: Sound designer Eddie Gandelman on composing a future that allows us to hear ourselves think It’s Not Easy Bein’ Green: ‘Wicked’ spells for struggle and solidarity Making Space: Jon M. Chu on Designing Your Own Path Runway modeler: Airport architect Sameedha Mahajan on sending ever-more people skyward